how to claim california renter's credit

The renters who are eligible to receive this tax deduction are. California allows a nonrefundable renters credit for certain individuals.

Legal Requirements For Denying A Rental Applicant Adverse Action Letter

Wednesday June 1 2022.

. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if. Use Screen 53013 California Other Credits to enter information for the Renters credit. 2 You cannot have total.

Ask tax questions and get quick answers online. In California renters who make less than a certain amount currently 41641. Tax credits help reduce the amount of tax you may owe.

The way you claim a renters credit your taxes varies from state to state. Fillable Form 1040 2018 Income Tax Return. Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips.

However you are not considered a tenant if you stayed for 30 days or. If you pay rent for your housing have a family with children or help provide money for low-income college students you may be. These states have worked out their own formulas for awarding a renters tax credit to eligible tenants.

In California renters who pay rent for at least half the year and. To claim the renters credit for California all of the following criteria must be met. See How to Generate the California Renters Credit for more information.

We support income tax rebate refund deduction questions and more. Free customer support for FreeTaxUSA users. How to claim california renters credit.

Complete the worksheet in the California instructions to figure the credit. The taxpayer must be a resident of. Renters Credit Nonrefundable If you paid rent for six.

Claiming the renters credit on your taxes. That being said each state has its own unique set of rules and we get into these specifics below. To claim the renters credit for California all of the following criteria must be met.

File either a California form 540 complete line 31 540A line 19 or 540 2EZ line 13 tax return. The maximum credit is limited to 2500 per minor child. Generally under California law lodgers and residents of hotels and motels have the same rights as tenants.

1 You must have lived in a rental unit for at least half of 2000.

Emergency Renters Assistance Program

California Rent Relief Program How Renters And Landlords Can Apply Who Qualifies

Best Cheap Renters Insurance In California 2022 Forbes Advisor

Emergency Renters Assistance Program

Caleitc And Young Child Tax Credit Official Website Assemblymember Wendy Carrillo Representing The 51st California Assembly District

How To Add An Eviction To A Tenant S Credit Report

California Tenant Rights Landlord Rental Lease Laws Aaoa

Exclusive Fannie Mae S Plan Bolster Renters Credit Scores

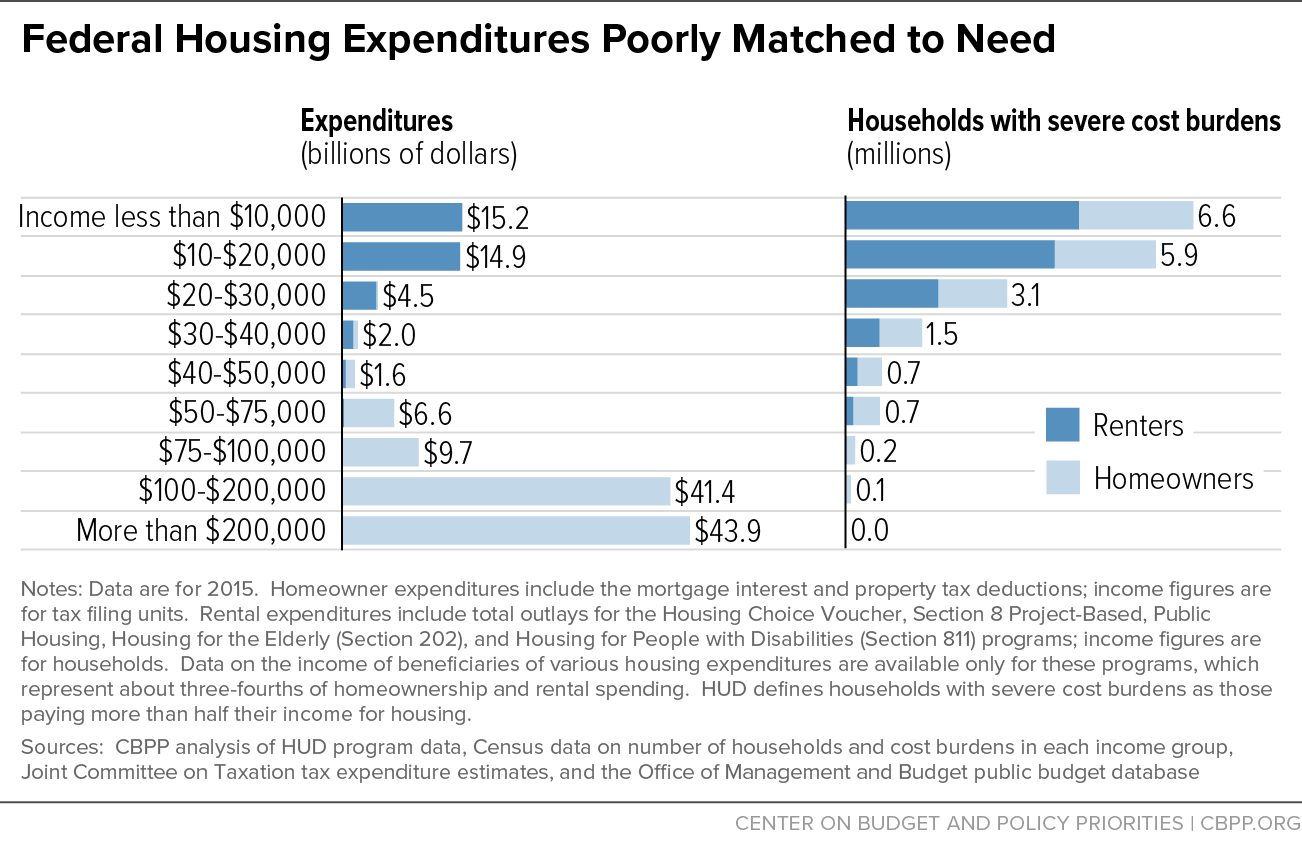

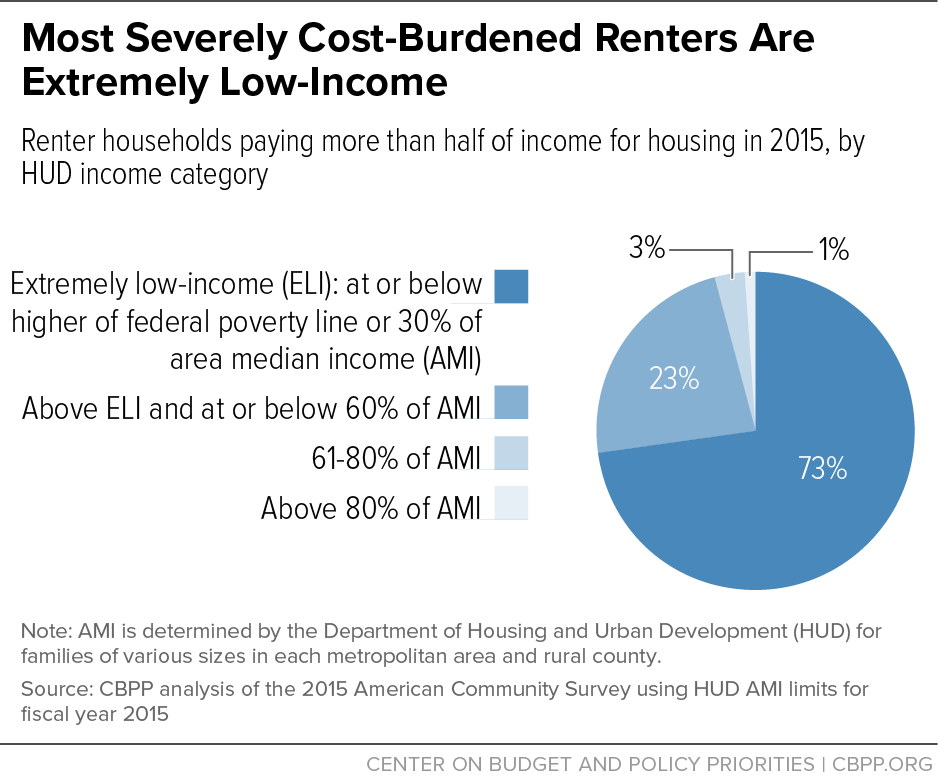

Renters Credit Would Help Low Wage Workers Seniors And People With Disabilities Afford Housing Center On Budget And Policy Priorities

Nearly Half Of L A Tenants Owe Back Rent Ucla

Renting A Property California Leasing Management

Renters Credit Would Help Low Wage Workers Seniors And People With Disabilities Afford Housing Center On Budget And Policy Priorities

Solved S Alexandra Single With No Dependents Has Waterfront Rental Property In Maine But She Is A California Resident The Rental Income Was 1 Course Hero

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Rental Property Tax Deductions A Comprehensive Guide Credible

Can A Renter Claim Property Tax Credits Or Deductions In California Newpoint Law Group

What You Need To Know About Eviction Moratoriums In California Los Angeles Times